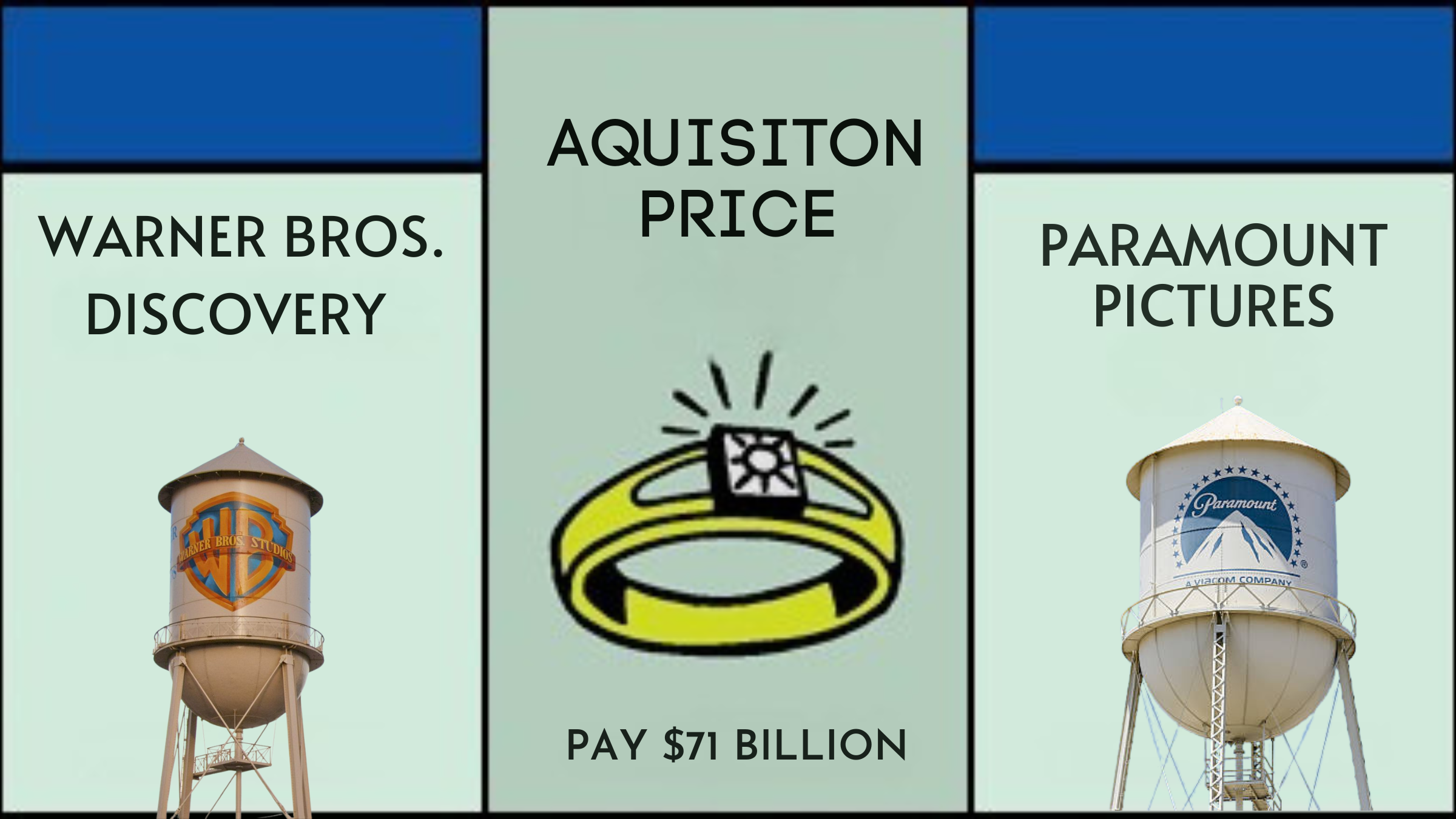

Paramount Explores Bid to Acquire Warner Bros. Discovery

Graphic Via The Cinema Group.

Fresh off its Skydance merger, Paramount sets sights on Warner Bros. Discovery in a potential game-changing industry move.

In yet another seismic shift for Hollywood, the newly merged Paramount Skydance is reportedly exploring a bid to acquire Warner Bros. Discovery. The deal, if realized, would mark a staggering consolidation of legacy media powerhouses and send ripple effects through every corner of the entertainment industry.

According to sources close to Paramount leadership, Skydance CEO David Ellison and his team have been assessing the pros and cons of such a deal for months. The Wall Street Journal broke the story earlier today, causing Warner Bros. Discovery shares to surge more than 30% in afternoon trading. While Paramount has yet to issue a formal statement, insiders confirm that Ellison has had his eye on Warner Bros. for some time.

This wouldn’t be a piecemeal acquisition. Reports indicate that Paramount is considering a full takeover of the entire Warner Bros. Discovery entity—not just its film studios, but also its sprawling television, streaming, and global content holdings. That’s a bold move considering WBD is still in the process of separating Warner Bros. Studios from its broader Discovery Global assets, with a target date set for April.

Backing the bid is the financial muscle of Oracle co-founder Larry Ellison, David Ellison’s father and one of the wealthiest individuals on the planet. The Ellison family recently closed its $8.4 billion acquisition of Paramount Global, giving them majority control and signaling their ambition to reshape the media landscape at scale.

Should this potential merger come to fruition, it would unite two of Hollywood’s most iconic studios—Paramount Pictures and Warner Bros.—under the same roof. The horizontal integration alone would raise red flags with antitrust regulators, particularly the Department of Justice. While WBD lacks FCC-regulated broadcast licenses that slowed the Skydance-Paramount deal, a Warner-Paramount merger could trigger serious scrutiny around market competition, content ownership, and consumer choice.

That legal risk is compounded by political complexities. Warner Bros. Discovery owns CNN, long a target of Donald Trump’s ire, while CBS News—owned by Paramount—has faced similar criticism. Although the DOJ typically operates independently of the White House, few would be surprised if the merger became a partisan flashpoint in an already volatile election year.

POPULAR ON THE CINEMA GROUP

Still, the logic behind the deal is clear: scale, synergy, and survival. With streaming wars intensifying and traditional media revenue shrinking, legacy companies are scrambling to consolidate IP, distribution, and global reach. For Ellison, bringing WBD into the fold would instantly boost Paramount's global market share, expand its streaming content arsenal, and solidify its standing against competitors like Disney, Netflix, and Amazon.

"John Malone moves in mysterious ways," one insider joked—referencing the influential Liberty Media founder and longtime WBD power player. Indeed, behind-the-scenes alliances and boardroom negotiations are likely already underway, even if no formal offer has been made public.

For now, both companies remain tight-lipped. But the message is clear: the age of mega-mergers is far from over. And if Paramount makes its move, the next phase of Hollywood’s transformation may already be in motion.

![Sundance 2026 Recap [Part i]

Another Sundance in the books. Last one in Park City— premieres, portraits, and the people who made it.

More to come!

📸: @jonathanpmoustakas on @sonyalpha

#sundancefilmfestival #sundance2026 #thecinemagroup](https://images.squarespace-cdn.com/content/v1/65c1a54efb10480185732c60/1770112011067-GAUJ8WUARIG299C1YW9J/image-asset.jpeg)