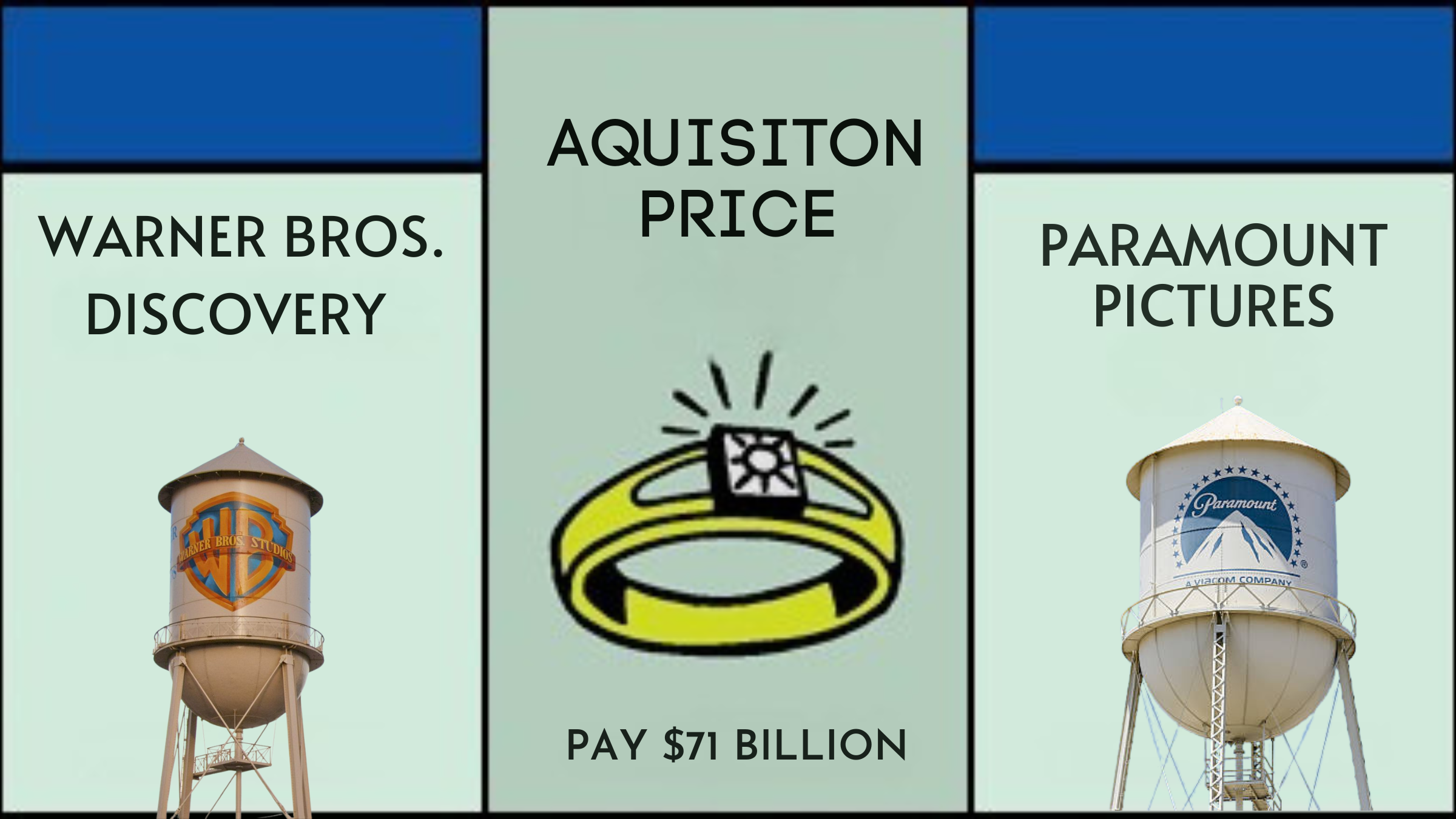

Netflix Enters the Warner Bros. Bidding War — And the Industry May Never Look the Same

Warner Brothers Discovery, Netflix

As Paramount and Skydance make moves, Netflix could pull off the ultimate industry power play: buying Warner Bros.

In a twist worthy of a streaming-era thriller, Netflix is reportedly exploring a bid to acquire Warner Bros. — or at least part of it. What began as a two-horse race between Paramount/Skydance and David Zaslav’s Warner Bros. Discovery has now expanded to include the world’s biggest streaming platform, hinting at a future where legacy Hollywood is fully absorbed into the streaming-first age.

According to a bombshell report from Puck News, Netflix is eyeing the film studio and its streaming arm, rather than acquiring all of Warner Bros. Discovery (WBD), which includes a sprawling portfolio of cable networks, IP divisions, and legacy broadcast arms. While David Ellison’s Skydance is already knee-deep in a proposed all-in acquisition, Netflix may be aiming for a more strategic slice of the pie — one that could still upend the power structure of the industry entirely.

The rumor mill intensified after Netflix co-CEO Ted Sarandos was spotted alongside WBD CEO David Zaslav at the Crawford–Álvarez boxing match in Las Vegas. It’s unclear whether the meet-up was business or pleasure, but industry insiders are buzzing with speculation that Netflix’s interest may be more serious — and more disruptive — than previously thought.

Unlike Skydance’s proposed all-in buyout, Netflix’s approach would prioritize vertical integration, leveraging Warner Bros.’ production machine and vast streaming library to further its own dominance in the space. With original Netflix hits like Wednesday, Stranger Things, Jay Kelly, and Knives Out under its belt, folding in Warner Bros. IP would be a seismic shift — giving Netflix access to DC Studios, Harry Potter, Looney Tunes, HBO Originals, and more.

But a deal this big comes with strings. WBD carries a substantial amount of debt, and any bidder would likely have to navigate the strategic divestment of legacy cable assets. In other words: Zaslav could be shopping the studio piece by piece, and Netflix may be preparing to grab the crown jewel before it’s gone.

Paramount, Ellison & the Race to Acquire

Milton Bradley,

Paramount and Skydance are still widely viewed as the frontrunners. Their merger closed in August, giving Ellison a new level of financial muscle bolstered by his father, Oracle co-founder Larry Ellison — whose net worth exceeds $350 billion. With that kind of backing, Skydance is reportedly unbothered by the massive cost of absorbing WBD whole.

Zaslav, however, isn’t sold on the idea. Puck notes that he’s unconvinced Ellison’s final offer will satisfy the board or investors. That hesitation may be Netflix’s opening. If Ellison flinches or delays, Netflix — with a strategic and more limited offer — could pivot the entire conversation. After all, unlike Ellison, Netflix doesn’t need cable networks or news divisions; it wants content, franchises, and subscriber growth.

Other potential bidders are also circling. NBCUniversal has reportedly run the numbers, though the logistics of such a mega-merger make that outcome unlikely. Still, their interest signals just how coveted Warner Bros. is — and how high the stakes are in the new Hollywood.

A Studio on a Winning Streak

Warner Bros. isn’t selling from a position of weakness. Despite the chaos of recent years and the controversial WBD merger, the studio is having a banner theatrical run. The 2025 slate includes massive hits like Sinners (from Ryan Coogler), Weapons (from Zach Cregger), the highly anticipated A Minecraft Movie, and James Gunn’s Superman. In fact, WBD made box office history this year with six straight $40M+ openings, a feat no studio has ever pulled off.

And on the horizon? Paul Thomas Anderson’s One Battle After Another, already being called one of the best films of the year ahead of release. Add to that future projects like Supergirl, Emerald Fennell’s Wuthering Heights, and a DCU relaunch, and Warner Bros. is not just stable — it’s hot.

POPULAR ON THE CINEMA GROUP

This success is exactly why the bidding war is so intense. Whoever acquires the studio will gain a forward-looking theatrical strategy, a treasure trove of content, and unmatched brand value. For Netflix, it’s a rare chance to own both the pipeline and the library — eliminating middlemen, expanding their awards footprint, and silencing critics who argue they lack theatrical impact.

Why It Matters

Netflix

If Netflix succeeds — or even comes close — it will signal the definitive end of the studio system as we know it. What began with blockbuster talent deals and exclusive streaming windows could culminate in Netflix becoming the owner of Casablanca, The Batman, Harry Potter, and Succession. It would be a consolidation of unprecedented scale, turning the disruptor into the new establishment.

There are still many unknowns. Will Zaslav sell the studio separately? Can Netflix stomach the price tag? Will regulators intervene?

But one thing is certain: the dominoes are falling, and Netflix has entered the chat.